2021 financial outlook largely exceeded:

• 2021 operating margin: 3.6% (vs. operating margin outlook of the same order as H1 2021 ie 2.8%) reaching, 2 years ahead of schedule, the Renaulution objective of an operating margin above 3% in 2023

• Automotive1 operational free cash flow (FCF) before change in working capital requirement: €1.6bn (vs the positive Automotive operational FCF outlook)

Renaulution objectives achieved in advance, acceleration of the Group’s strategy:

• Cash fixed cost reduction plan of €2bn compared to 2019 carried out one year ahead of schedule

• Reduction of breakeven point2 by 40% compared to 2019, achieved 2 years in advance (initial reduction target of more than 30% by the end of 2023)

• Efficiency of the Renaulution commercial policy, which favors value over volumes (price effect at +5.7 points in 2021) and which will continue in 2022

• Group orderbook in Europe with more than 3 months of sales, supported by the attractiveness of the Renault E-TECH offer, Arkana, light commercial vehicles, Dacia Sandero and Dacia Spring 100% EV

• Continued improvement in 2022 in the product mix and enrichment of vehicles in particular with the launch of Renault Megane E-TECH and Austral, Dacia Jogger

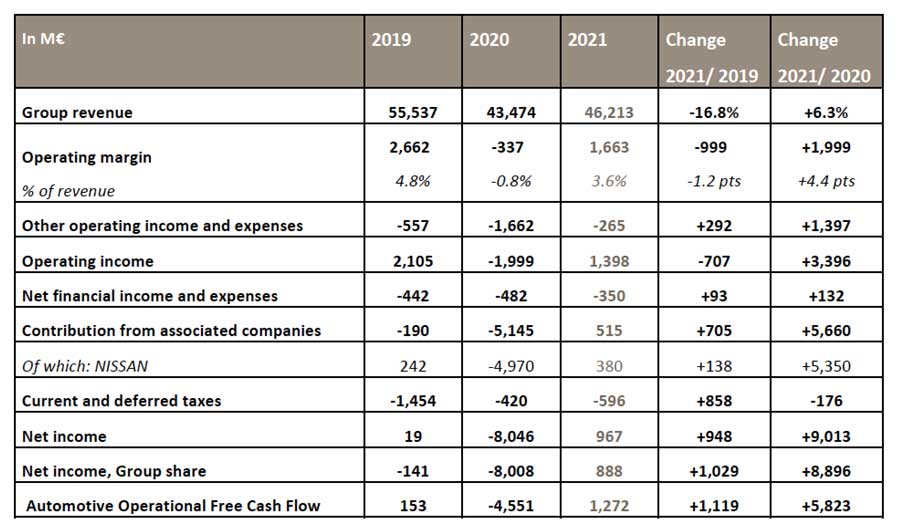

2021 results:

• Group revenue at €46.2bn: +6.3% vs. 2020

• Group operating margin at €1.7bn (3.6% of revenue): up €2bn vs. 2020, reaching 4.4% in the second half of 2021

• Automotive1 operating margin at €507m (1.2% of segment revenue): up €1.8bn vs. 2020 (+4.4 points)

• Net income at €967m

• Automotive1 operational free cash flow after change in working capital requirement: €1.3bn, contributing to the €2bn reduction in Automotive net debt

• In 2021, Renault Group confirms it achieved its CAFE3 targets (passenger cars and light commercial vehicles) in Europe thanks in particular to the performance of its E-TECH4 sales, which represent nearly a third of Renault brand passenger car registrations in Europe (vs. 17% in 2020)

2022 outlook:

• a Group operating margin superior or equal to 4%

• an Automotive operational free cash flow superior or equal to €1 bn

In an environment still impacted by the semiconductor crisis, particularly in the 1st half of 2022 (total loss estimated at 300,000 vehicles on 2022 production), and by the increase of raw materials prices, the Group is aiming to achieve for the full year:

Ahead of its mid-term Renaulution objectives, the Group will organize a Capital Market Day in the fall of 2022.

“Renault Group largely exceeded its 2021 financial targets despite the impact of semiconductor shortages and rising raw material prices. This reflects the sustained pace of the in-depth transformation of the Group, initiated within the framework of Renaulution. Thanks to the continuous commitment of the teams and by capitalizing on the Alliance, we are accelerating the deployment of our strategic ambitions, in order to position the Group as a competitive, tech and sustainable major player.” said Luca de Meo, CEO of Renault Group

“With these 2021 results, Renault Group reached a further step in its recovery. This performance is due to the early successes of the Group strategy, promoting value over volumes, and its strict financial discipline. It allowed us to achieve in a sustainable way, and one or two years in advance, some objectives of Renaulution. The Group is further accelerating the implementation of its strategic projects with the single target of creating value for all its stakeholders.” said Clotilde Delbos, CFO of Renault Group

Group revenue reached €46,213m, up 6.3% compared to 2020. At constant scope and exchange5 rates, it increased by 8.0% (negative exchange rate effect mainly related to the devaluation of the Russian Ruble, the Turkish Lira, the Argentine Peso and the Brazilian Real).

Automotive revenue excluding AVTOVAZ amounted to €40,404m, up 7.1% compared to 2020.

The recovery of the automotive market contributed 4.4 points.

The new commercial policy, launched in the 3rd quarter of 2020 and focusing on the most profitable segments, led to a positive net price effect of 5.7 points. The success of Arkana, launched in the second quarter of 2021 and highlighting the return of Renault brand in the C segment, and the light commercial vehicles performance generated a positive product mix effect of 2.2 points. These two effects allowed to compensate for the loss of volume of 7.5 points mostly linked to the implementation of this “value over volumes” policy.

The “Other” effects, of +5.3 points, came from the decline in sales with buy back commitments in line with the policy of selecting the most profitable channels and following the disposal of several Renault Retail Group branches in 2021. The increase in aftersales contribution and the recovery of network activity, strongly impacted by the lockdown measures in 2020, also contributed positively.

AVTOVAZ’s revenue increased by 10.4% to €2,850m, mainly due to strong price increases and a product mix effect of +18.4 points, more than offsetting the negative impact of currencies (-6.8 points). The LADA brand maintained its leadership in Russia with a market share of nearly 21%. LADA Vesta and LADA Granta sales ranked respectively at the 1st and 2nd place in Russia.

The Group recorded a positive operating margin of €1,663m (3.6% of revenue) compared to -€337m in 2020. It reached 4.4% of revenue in the second half of 2021.

Automotive operating margin excluding AVTOVAZ improved by €1,710m to €260m (0.6% of revenue). The recovery of the automotive market had a positive impact of €293m.

The mix/price/enrichment effect of €1,127m was the result of the commercial policy favoring value over volumes and price increases to cover exchange rate devaluations and cost inflation. This policy more than offset the negative volume effect of €579m.

The “Productivity” effect (purchasing, warranty, R&D, manufacturing & logistics costs, G&A) was positive by €852m, mainly due to purchasing performance (€541m) and the optimization of R&D expenses.

These operational performances largely offset the rise in raw material prices, which weighed for -€468m.

The “Other” effects amounted to +€483m. The major contributors are stronger performance from parts and accessories, from our owned network and a favorable impact of sales with buy-back commitments.

AVTOVAZ’s operating margin amounted to €247m, up €106m, mainly reflecting the price increases that more than offset the negative currency effect and the increase in raw material prices.

The contribution of Sales Financing to the Group’s operating margin reached €1,185m, an increase of €178m compared to 2020. This increase is mainly the result of a sharp improvement in the cost of risk, which stood at 0.14% of average performing assets compared to 0.75% in 2020. This very good level is explained by the improvement in risk parameters and a return to normal recovery processes impacted by the lockdowns in 2020.

RCI Bank and Services posted new financing growth of 0.4% (excluding negative currency effects of -€92m) compared to 2020, helped by the strong performance of used vehicle financings and by average financed amounts up 7.2% on new and used vehicles.

Other operating income and expenses were negative at -€265m (compared to -€1,662m in 2020). Provisions for restructuring charges of -€430m were offset by asset disposals (€487m) mainly related to the sale of several Renault Retail Group (RRG) branches in line with the announced strategy.

After taking into account other operating income and expenses, the Group’s operating income stood at €1,398m compared to -€1,999m in 2020.

The financial result amounted to -€350m, an improvement of €132m compared to 2020, mainly related to the accounting revision of the carrying value of the loan guaranteed by the French State.

The contribution of associated companies amounted to €515m, including €380m related to Nissan’s contribution, an increase of €5,660m compared to 2020. As a reminder, Nissan’s contribution in 2020 included -€4,290m in impairments and restructuring costs (including -€1,934m of IFRS restatements).

Current and deferred taxes represented a charge of -€596m compared to a charge of -€420m in 2020 related to the improvement in the result.

Net income was €967m and net income, Group share, was €888m (+€3.26 per share compared to -€29.51 per share in 2020).

The cash flow of the Automotive6 business, excluding restructuring expenses, included €1bn of RCI dividends and reached €4.8bn, an increase of €2.8bn compared to 2020.

This cash flow covered the tangible and intangible investments before asset disposals which amounted to €3.2bn (€5.1bn in 2020).

Excluding the impact of asset disposals, the Group net CAPEX and R&D rate amounted to 8.5% of revenue. It amounted to 7.3% including asset disposals compared to 11.3% in 2020.

Automotive6 operational free cash flow was positive at €1,272m, after taking into account payments for restructuring expenses of -€602m, asset disposals of €574m and a negative impact of the change in working capital requirement of -€330m.

The Automotive operational free cash flow and the sale of shares held in Daimler for €1.1bn contributed to the €2bn reduction in Automotive net debt which stood at €1.6bn at December 31, 2021.

As of December 31, 2021, total inventories of new vehicles (including the independent dealer network) represented 336,000 vehicles compared to 486,000 at the end of December 2020, or 53 days of sales.

The Board of Directors will propose to the Assembly General Meeting, scheduled for May 25, 2022, to not pay a dividend for the 2021 financial year.

In 2022, Renault Group will make an early repayment of €1bn of the loan from a banking pool guaranteed by the French State as well as €1bn relating to the mandatory annual reimbursement. The loan will be fully reimbursed by the end of 2023 at the latest.

Decarbonization and fair transition at the heart of our ESG strategy

In 2021, Renault Group released its Corporate purpose: “Our spirit of innovation takes mobility further to bring people closer” and published its ESG strategy based on 3 pillars: carbon neutrality, safety and inclusion.

Renault Group aims to achieve carbon neutrality in Europe by 2040 and worldwide by 2050 by reducing its carbon emissions over the entire life cycle of the vehicle: materials and components purchased, production sites, vehicle emissions on the road, second life but also recycling. This Climate Strategy was presented in the Climate Report published in April 2021.

Over the past decade, Renault Group and the Alliance have already invested more than €10bn in electrification. This movement is accelerating: the Alliance will invest €23bn over the next five years. Thanks to the 5 common electric platforms covering most segments, Renault brand aims to become 100% electric by 2030 for passenger cars in Europe.

More than one year ago, Renault Group launched the ReFactory project to transform the Flins plant (Yvelines, France) into the first European factory dedicated to the circular economy of mobility and structured around 4 activity centers:

– RE-TROFIT with the “Factory VO” (Used Vehicles), the first factory specialized in the retrofitting and refurbishing activities of used cars on an industrial scale;

– RE-ENERGY contributing to the development of applications for the 2nd life of batteries and new energies;

– RE-CYCLE bringing together recycling and reuse of parts and materials;

– RE-START, innovation and training center project, bringing together 3 entities: an innovation center dedicated to the industry 4.0, a training campus and an incubator dedicated to research and innovation in the circular economy.

The Flins ReFactory aims to retrofit 45,000 vehicles per year by 2023 and repair 20,000 batteries per year by 2030, with 3,000 jobs on site in 2030. This global industrial project is intended to be deployed more widely, like the project launched at the Seville plant.

Finally, Renault Group is rethinking its organization to support the transformation of the automotive industry’s professions and launched in 2021 the ReKnow University dedicated to the acquisition of new skills in the electrification, analysis and cybersecurity of data or the recycling of vehicles and their batteries. In France, 2,600 people were upskilled or reskilled in 2021 and more than 3,000 will be trained in 2022 with an objective of 10,000 people in 2025.

• a Group operating margin superior or equal to 4%

• an Automotive operational free cash flow superior or equal to €1 bn

Outlook & Strategy

2022 outlook

In an environment still impacted by the semiconductor crisis, particularly in the 1st half of 2022 (total loss estimated at 300,000 vehicles on 2022 production), and by the increase of raw materials prices, the Group is aiming to achieve for the full year:

• a Group operating margin superior or equal to 4%

• an Automotive operational free cash flow superior or equal to €1 bn

Thanks to its performance, Renault Group is in a position to accelerate its Renaulution strategy by leveraging its industrial and technological assets:

– Renault Group confirms its ambition in EV with the objective for the Renault brand to be 100% EV in Europe by 2030. To this end, Renault Group is studying the opportunity to bring together its 100% electric activities and technologies within a dedicated entity in France to accelerate their growth.

– At the same time, Renault Group is also studying the opportunity to bring together its activities and technologies of ICE and hybrid engines and transmissions based outside of France within a dedicated entity, in order to strengthen the potential of Renault Group’s technologies and know-how.

The results of these considerations will be shared regularly with the various representative bodies of the Group and will be the subject of information and/or consultation procedures in accordance with the regulations in force in the various countries involved.

Ahead of its Renaulution mid-term objectives and in line with the results of these strategic reflections, Renault Group will present, at a Capital Market Day in the fall of 2022, an update on its strategy in order to position the company as a competitive, tech and sustainable major player.

Renault Group’s consolidated results

Additional information

The consolidated financial statements of Groupe Renault and the company accounts of Renault SA at December 31, 2021 were approved by the Board of Directors on February 17, 2022 met under the chairmanship of Jean-Dominique Senard.

The Group’s statutory auditors have conducted an audit of these financial statements and their report will be issued shortly.

The earnings report, with a complete analysis of the financial results in 2021, is available at www.group.renault.com in the “Finance” section.

1 The ”Automotive” operational scope includes AVTOVAZ

2 Cash breakeven without RCI dividend, WCR change & restructuring, excluding AVTOVAZ and China JVs

3 These results should be consolidated and formalized by the European Commission in the coming months. CAFE = Corporate Average Fuel Economy

4 The E-TECH range consists of electric vehicles and hybrid engines

5 In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current financial year by applying average exchange rates of the previous period.

6 The ”Automotive” operational scope includes AVTOVAZ