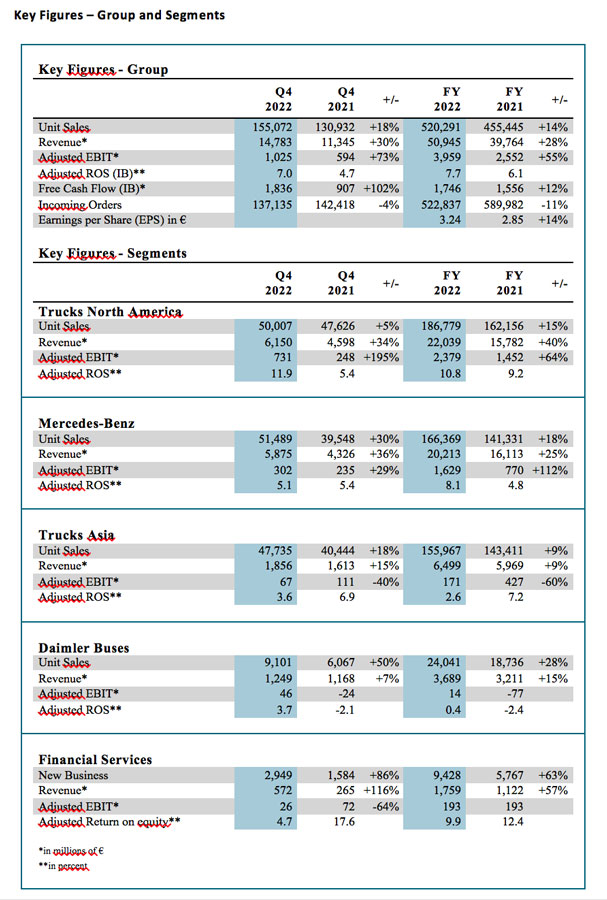

In its first full year as a listed company, Daimler Truck Holding AG (Daimler Truck) has successfully delivered on strategic ambitions – leading sustainable transportation and improving the overall profitability. The Group achieved its financial targets for 2022 and is positive for 2023 despite supply chain constraints and inflationary cost pressure. Daimler Truck benefitted from a robust demand in its key commercial vehicle markets and increased its unit sales, revenue, EBIT (Earnings before Interests and Taxes), industrial free cash flow and earnings per share. With 520,300 units, 14% more trucks and buses have been sold worldwide in 2022 compared to prior-year level (455,400 units) – underlining Daimler Truck’s strong market position. While demand continued to be strong across core markets with order intake and order backlog remaining at high levels, bottlenecks in the supply chains continued to impact production. Supported by the significant growth in unit sales, strong net pricing, favorable exchange rates and a positive development of the services business, the Group’s revenue increased to €50.9 billion in 2022 (+28% compared to previous year: €39.8 billion).

2022 also showed a favorable development for earnings and return on sales. The adjusted EBIT rose by 55% to €3,959 million (2021: €2,552 million), the adjusted ROS of the Industrial Business was at 7.7% in 2022 (2021: 6.1%). Daimler Truck’s free cash flow of the Industrial Business increased by 12% to €1,746 million in the reporting year (2021: €1,556 million). Earnings per share (EPS) amounted to €3.24, up 14% compared to 2021. All in all, Daimler Truck delivered on the targets for 2022 for profitability and margin improvement despite headwinds due to supply chain bottlenecks.

Successful first year as a listed company

Daimler Truck made significant strategic progress across many areas during its first year as a listed company. Against the ambition to lead in sustainable transportation, a series of new products and services have been introduced. Several new zero emission vehicles (ZEV) were launched: The electric Freightliner eCascadia started into series production in North America as well as the Mercedes-Benz eEconic in Germany. At the IAA Transportation 2022, the battery-electric Mercedes-Benz eActros LongHaul won the prestigious “2023 Truck Innovation Award”. The series-production eActros LongHaul will have a range of around 500 kilometers on a single battery charge and will be capable of high-performance charging. Daimler Truck subsidiary Mitsubishi Fuso Truck and Bus Corporation (FUSO) unveiled the battery-electric Next-Generation FUSO eCanter both in Japan and Europe.

New products were also launched to service large profit pools: The next generation of the Setra TopClass and ComfortClass, the new Mercedes-Benz Tourrider, a touring coach specially developed for the North American market, and Daimler Truck North America’s all-new Western Star 57X long-haul truck. Daimler Truck also announced restructuring programs for both its Mercedes-Benz segment in Brazil and the Daimler Buses segment, underlying the importance for self-help measures to achieve profitability improvements by 2025. Daimler Truck also announced innovative partnerships including with high-tech machinery manufacturer Manz as well as infrastructure joint ventures in the two core regions of North America and Europe for battery-electric and hydrogen-powered commercial vehicles. Financial Services continued its ramp-up: The segment launched business operations in eight further countries and was active in 15 markets at year end. Daimler Truck successfully issued several bonds at the capital market, supporting the growth of Financial Services.

Martin Daum, Chairman of the Board of Management of Daimler Truck comments: “2022 was a very special year for us, a challenging year in many ways – yet above all a successful first year for Daimler Truck as an independent listed company. Our strong results show that we managed our environment very well, be it the impact of Russia-Ukraine war, ongoing supply chain constraints or high inflation. We have made strong progress towards unlocking our profit potential, and we have also made further important steps regarding our ambition to lead sustainable transportation and to tackle climate change.”

Dividend

For the 2022 financial year, the Board of Management and the Supervisory Board of Daimler Truck Holding AG will propose to the Annual General Meeting on 21 June 2023 a dividend payment of €1.30 per share.

Group Outlook for 2023

Despite ongoing difficult economic conditions in 2023, high energy prices and tension in some supply chains, Daimler Truck expects a robust development in important commercial vehicles sales markets. Reflecting the two major regions North America and Europe, the Group’s guidance estimates both heavy-duty truck markets in North America and Europe to amount between 280,000 and 320,000 units. Daimler Truck anticipates unit sales in 2023 in a range between 510,000 and 530,000 units.

The Group expects a significant increase of its revenue, ranging between €53 billion and €55 billion in the Industrial Business and between €55 billion and €57 billion on Group level. Daimler Truck is further expecting a significant increase of its adjusted EBIT. The adjusted ROS of the Industrial Business is anticipated to range between 7.5% and 9%. Daimler Truck expects the free cash flow of the Industrial Business to be higher in 2023 compared to the previous year.

Jochen Goetz, CFO of Daimler Truck: “With an adjusted EBIT of €4.0 billion we took a major step forward in a challenging market environment with supply constraints and inflation, achieving a record level of EBIT for the Group. We were also able to continue our strong cash conversion. We want to pay our first dividend and establish an attractive capital allocation policy. We are on a journey to benchmark profitability, but there is still a way to go, especially on costs given the inflationary pressures. Our outlook shows that we will continue our self-help measures to improve our financials.”