Ebusco (Euronext: EBUS) announces a trading update for Q3 2024 and further details of its Turnaround Plan, designed to meet its current operational and financial difficulties.

The Turnaround Plan

At general meeting of shareholders Ebusco presents further details of its Turnaround Plan. The purpose of the plan is to improve the overall performance of the company and to restore and retain the confidence of stakeholders in the company as a reliable and valued business partner. The presentation is available on investors.ebusco.com.

Under the Turnaround Plan, the company has decided to fully adopt an Original Equipment Design (OED) manufacturing model, in which buses are designed and engineeredmailto:investors@ebusco.com by the company, but are assembled by contract manufacturers, instead of in-house produced by the company and to continue its focus on the European market only for its sales and marketing.[1]

Through the implementation of the Turnaround Plan, Ebusco aims to achieve the following targets by the end of 2025:

- a gradual increase of the monthly run rate to 40-50 buses (from c. 15 buses on average per month in 2024 year to date); and

- a structural annual cost reduction of approximately EUR 30 million.

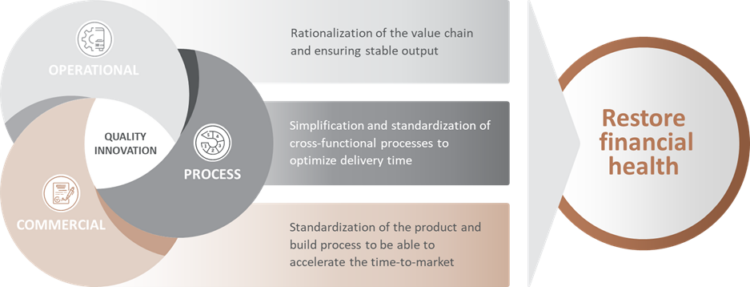

The Turnaround Plan has been structured to focus on the following three objectives, which are all aimed at ensuring a stable and timely operational output, enhancing overall efficiency and improving Ebusco’s working capital position:

- Rationalization of the value chain, which is the process of optimizing and streamlining the manufacturing and assembly process with the contract manufacturers;

- Simplification and standardization of cross-functional processes; and

- Standardization of the product-and-build process, which is the process of standardizing the company’s buses and their manufacturability.

As part of the Turnaround Plan, Ebusco will rationalize its footprint of production locations by reducing the number of locations from seven to five, including through combining the facilities in Deurne and Venray into one. Following the footprint rationalization, Ebusco will have one location in the Netherlands, one in France (Rouen) and three contract manufacturers.

Ebusco has made a solid start with the execution of the Turnaround Plan with the first reductions in FTEs and first initiatives to create a leaner organization, partly through the reduction of obsolete processes. Management has initiated a structured process to manage the reduction in FTEs to ensure that execution is done with minimal disruptions and costs.

Ebusco expects that effectively all of the actions under the Turnaround Plan will be completed before the end of 2025.

Turnaround Plan governance

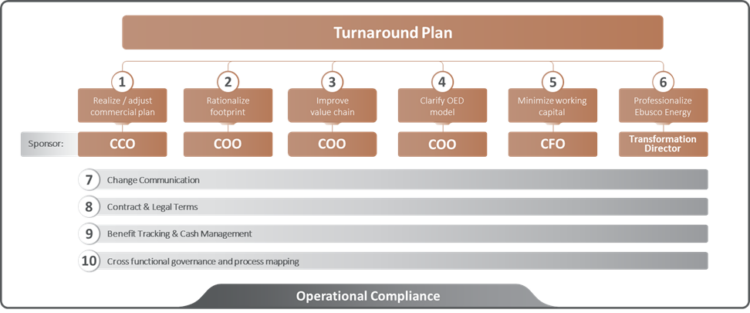

To achieve the above mentioned targets and objectives, the company has designed a governance structure for the Turnaround Plan based on six workstreams:

The Turnaround Plan also includes a number of cross-functional elements that are relevant for each of the six workstreams. The cross functional elements are change communication, optimization of the procurement and tender management processes, improvement of the benefit tracking and cash management processes and introduction of a cross-functional governance and process mapping. As an overarching principle the company will be focused on operational compliance throughout the organization while implementing the Turnaround Plan, with a focus on lean processes.

Implementation of the Turnaround Plan will be led by a Steering Committee comprising the company’s CEO, COO, CFO and Michel van Maanen, who was hired by the company on a consultancy basis as per 1 October 2024 for the role of Transformation Director. To safeguard company wide support for the Turnaround Plan, each workstream is owned and sponsored by a member of the management team, reporting to the CEO. Each workstream has milestones, goals and targets, which will be tracked and traced on a regular basis, and are subject to review by the management team. A Transformation Office, led by the Transformation Director, is tasked with the day-to-day oversight of the Turnaround Plan.

Management changes

The Chief Executive Officer, to be appointed at today’s EGM, will lead the implementation of the Turnaround plan.

The tasks of the Chief Technology Officer are combined with that of the Chief Operating Officer, to achieve a leaner organization and reduced management team size.

Jurjen Jongma, the Chief Financial Officer (CFO) of Ebusco has announced that he will leave the company after the completion of the intended rights issue. Jurjen has by that time led two capital injection rounds for Ebusco and is looking forward to a new challenge. The search for a new CFO has started and Jurjen will remain available to hand over his tasks to his successor. Ebusco would like to thank Jurjen for his dedication and professionalism to help manage Ebusco through challenging times and respect his decision.

Licensing revenue

In addition to the Turnaround Plan, Ebusco’s aim is to also tap new sources of revenue. Ebusco is in negotiations to license its Ebusco 3.0 lightweight technology. Opportunities are sought outside Europe, mainly in North America. If successful, this will add revenue and liquidity in 2024 and beyond.

Strategic partnership

Ebusco is negotiating a partnership with one of its strategic suppliers. The terms of the partnership provide for an equity injection into Ebusco strengthening its balance sheet, and cementing a long-term strategic partnership. Ebusco expects to finalize the negotiations and announce details of the partnership ahead of the launch of the rights issue.

Rights issue

As announced by the company on 10 September 2024, Ebusco is seeking to raise EUR 36 million in new equity through a rights issue, in order to facilitate the full implementation of the Turnaround Plan.

The rights issue is directed at the existing Ebusco shareholders. They will be offered the opportunity to buy new shares in Ebusco at a discount. Shareholders that do not wish to invest can sell their rights via the stock exchange. This enables the current investors of Ebusco to inject the required equity at a discounted price.

In the event not all rights are exercised, Ebusco will issue the relevant shares to other investors. Ebusco is currently in discussion with a number of interested parties that are willing to subscribe for these shares, at the same discount as offered to the existing investors. If the rights issue does not raise the full amount of EUR 36 million, it is expected that Ebusco will cancel the offering.

Christian Schreyer, CEO of Ebusco, comments: “Ebusco is going through a very difficult phase. Despite being aware of the difficulties, I chose to join Ebusco in September, driven by the company’s potential. The Ebusco buses have shown excellent performance, including through the lowest energy consumption in the market. With my deep familiarity and experience in this industry, I can confidently say that Ebusco’s products have tremendous potential. However, I recognize that this potential has not been properly utilized, as Ebusco is facing financial challenges along the way. We need to turn Ebusco around. Together with the Ebusco team, we have developed a plan to create a leaner organization, restore the trust in Ebusco as a company for all our stakeholders and restore our financial health. With the shift in manufacturing strategy, Ebusco will concentrate on the engineering of its products and inhouse casco production, while outsourcing the assembly activities to experienced contract manufacturers. I am fully focused on implementing the Turnaround Plan. I believe that with this approach, our proven products and the support of our shareholders and the capital markets, Ebusco is well-positioned to meet the ongoing high demand for electric buses in the European market.”

Reasons for the Turnaround Plan

The Turnaround Plan is needed to secure the future of Ebusco. In the recent past the company has increasingly come under pressure, both operationally and financially.

Working capital

The third quarter of 2024 saw a continuation of the operational difficulties Ebusco has been facing, and that have been announced in its earlier press releases. Production of new buses has now come to an almost standstill, which means that buses are hardly being delivered, further exacerbating the company’s financial position and leading to a severe cash shortage.

As a result of the production that has come to an almost stop, the cancellations of orders by customers, claims of late delivery penalties and direct damages, Ebusco’s most recent liquidity forecast shows that the lowest point in working capital in 2025 will occur in Q1 2025. In response, Ebusco has initiated the following measures:

- In active dialogue with various existing customers on sale of 61 cancelled buses;

- Conversion of account payable positions of a key supplier and strategic partner into equity;

- Sell-down of inventory to traders and suppliers;

- Further managing overdue supplier credit; and

- Acceleration of production and delivery of Ebusco 2.2 buses.

Through a combination of these working capital measures and the rights issue, Ebusco expects to be able to bridge the working capital gap to provide the company with sufficient working capital to meet its obligations up to Q1 2025 and beyond. This assumes completion of the rights issue in November 2024.

Customer orders, deliveries and cancellations

In the first 9 months of 2024, Ebusco delivered 135 buses, of which 37 were delivered in the last quarter. The orderbook as at 30 September 2024 is set out below.

| Type | Fixed contracts | Call off | Options | Total |

| Ebusco 2.2 | 125 | 123 | 660 | 908 |

| Ebusco 3.0 | 569 | 0 | 118 | 687 |

| Total | 694 | 123 | 778 | 1,595 |

As announced on 21 October 2024, Ebusco has received notice from one of its customers to cancel orders of 59 buses, of which 45 are 12-meter buses. All of these 12 meter buses are produced, with 30 being in the Netherlands / Europe available for delivery. The remaining buses comprise 10 which are in transit to and 5 which are about to be shipped to the Netherlands. Ebusco litigated against the cancellation.

The court, however, denied Ebusco’s request. As a result, Ebusco will use the buses produced for this customer to fill the other orders in its orderbook. However, this will likely generate revenue for 2025 and not 2024. In addition, it will need to incur the cost of re-customizing these buses to meet the replacing customer’s specifications.

Overdue accounts payable & late delivery penalties and direct damages

Ebusco currently has overdue accounts payable positions, in the amount of approximately EUR 33 million, for which it is actively engaging with its critical creditors to discuss payment schedules and alternative settlements options due to the company’s current financial situation, and these accounts payable positions have caused production to be almost fully at standstill as discussed above.

In addition, Ebusco is facing penalties and direct damages claims for late delivery of buses. Based on the company’s production planning in place, many orders will not be delivered on time. Ebusco is currently in settlement negotiations on these penalties and claims and has assumed related cash-out in its liquidity forecast.

Furthermore, Ebusco is in arrears in relation to certain payments to the Dutch tax authorities for which part of the assets have been pledged.

Energy Solutions

As at 30 September 2024, Ebusco’s order book for Energy Solutions is set out below.

| Type | Fixed contracts | Options | Total |

| Energy Storage System (ESS) | 1 | 0 | 1 |

| Mobile Energy Container (MEC) | 20 | 0 | 20 |

| Ebusco Maritime Battery (EMB) | 2 | 0 | 2 |

| Ebusco Charging System (ECS) | 7 | 5 | 12 |

| Total | 30 | 5 | 35 |

Due to a delayed finalization of a certification program for the services offering of Ebusco Energy Solutions, Ebusco has not been able to deliver all its MEC and ESS systems on time. It is in the process of addressing this, in order to strengthen its financial position.

Guarantee facilities

The Group has received notice from the lending parties under its guarantee facilities of breach of payment obligations under such facilities in the amount of approximately €6.2 million. Ebusco has granted security rights to its lenders in accordance with the terms of the facilities, in anticipation of the company’s refinancing.

CMD Cancellation

Earlier this year, Ebusco announced a Capital Markets Day (CMD) scheduled for November 2024. Ebusco’s strategy update is embedded in the Turnaround Plan. This will be presented and discussed at EGM, which means the need for a separate CMD is superseded.

Financial calendar for 2025

| 9 February – 25 March 2025 | Closed period | |

| 26 March 2025 | Full Year Results 2024 | |

| 14 May 2025 | Annual General Meeting (AGM) | |

| 30 June – 29 July 2025 | Closed period | |

| 23 July 2025 | Half Year Results | |

| 5 October – 14 October 2025 | Closed period | |

| 15 October 2025 | Trading update Q3 | |

[1] Except for monoparts production in the Netherlands and casco assembly in France